Mobile Money

As is the case for all developing countries, Ugandan is a cash-driven society. The lack of widespread use of credit cards creates numerous challenges for all sectors of society, including the judiciary. In the United States, the court system can purchase supplies and pay all sorts of suppliers and vendors via government credit cards and/or a system of invoicing. The same is not true in Uganda.

There are no government credit cards and virtually every purchase is a cash transaction, most of which don’t usually generate receipts. Consequently, opportunities for corruption are widely available and too often utilized. This, in turn, leads to the creation of systems that cause immense delay and incredible inefficiency. For example, many of the courts in Uganda operate via “session” calendaring. Criminal cases are not heard on a rolling basis, but rather in “sessions.” This means that forty cases are set for a session that will occur over a two or three month time period. A judge may have two or three sessions a year. This is solely driven by the fact that the cash to pay for the session has to be requisitioned in advance. The cash is largely to pay for witnesses to come to court (who otherwise won’t or can’t afford to come), to pay for fuel for the transportation for the buses to bring the defendants from prison to court, and to pay for the transportation of files from the police station or from one court to another.

Interestingly, this incredibly inefficient and antiquated system of having to pay for everything by cash has combined with the ubiquity of cell phones to create a money movement innovation that is actually somewhat ahead of the West. This innovation is called Mobile Money and it is rapidly gaining popularity in Uganda. In fact, my prediction is that Uganda will skip credit cards altogether. (A similar thing happened in telecommunications – cell phones became affordable before infrastructure was in place for landlines. Accordingly, virtually no houses and not many businesses have landlines, which is where the US is clearly heading).

Mobile Money operates off of the cell phone platform (MTN is the biggest player in the cell phone market and got an early jump on Mobile Money relative to its competition). Here is how it works: a customer will take cash to an authorized Mobile Money dealer (there are tons of them around within easy reach). The dealer creates a Mobile Money account for the customer and places the amount of the deposit on the customer’s account (minus a very modest fee). The customer then merely needs to input a passcode into the program on the phone to get access to the money. At that point, Mobile Money works just like PayPal – the most popular system in the US for moving money around via the internet.

Mobile Money

With the increasing use of Mobile Money by regular folks, an increasing number of businesses are accepting Mobile Money as a form of payment for goods and services. One person with a Mobile Money account can immediately transfer money to another account holder with the stroke of a few keys on the phone. Accordingly, borrowing a few bucks (or shillings) from a friend is more easily accomplished via text message than it is to reach into a wallet, remove the bills, hand them to someone else, who then puts the bills into her purse.

Old fashioned theft mechanisms of purse of wallet snatching may quickly become a thing of the past as cash may soon be unnecessary. (Phone theft is pointless because the money can only be accessed with a password and the account can be frozen in a matter of minutes via a Mobile Money dealer). I can imagine a day soon where beggars on the street will be holding up signs with their Mobile Money account numbers.

In a very real sense, then, Uganda may actually be closer to going totally cashless than the US.

P.S. Henry just called from his school and reported that his first three days have gone exceedingly well and he has “very many” friends. Thanks for all the prayers on his behalf.

I like the idea of a society that doesn’t foster credit card debt. It sounds like it requires good record keeping and follow through to ensure one isn’t taken advantage of. Hard to see the down side… Keep blogging, I appreciate the cultural insight and perspective! (Not to mention knowing how to pray for your family.)

I’m wondering — does Henry know he’s a starfish?

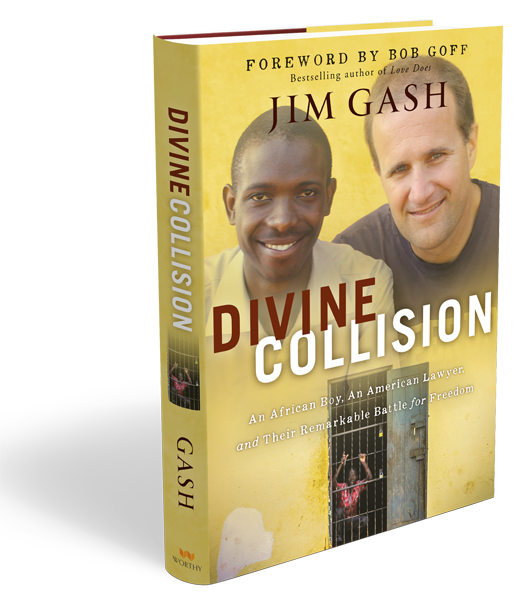

Good question, Corleen. Henry does know. He and I are in the process of finalizing a manuscript together entitled “Throwing Starfish” that details the background and unfolding of this unlikely friendship. The last chapter will be complete when I argue the appeal in his case before the Ugandan Court of Appeals, which is scheduled to take place in April.